By Jon Queally/Common Dreams

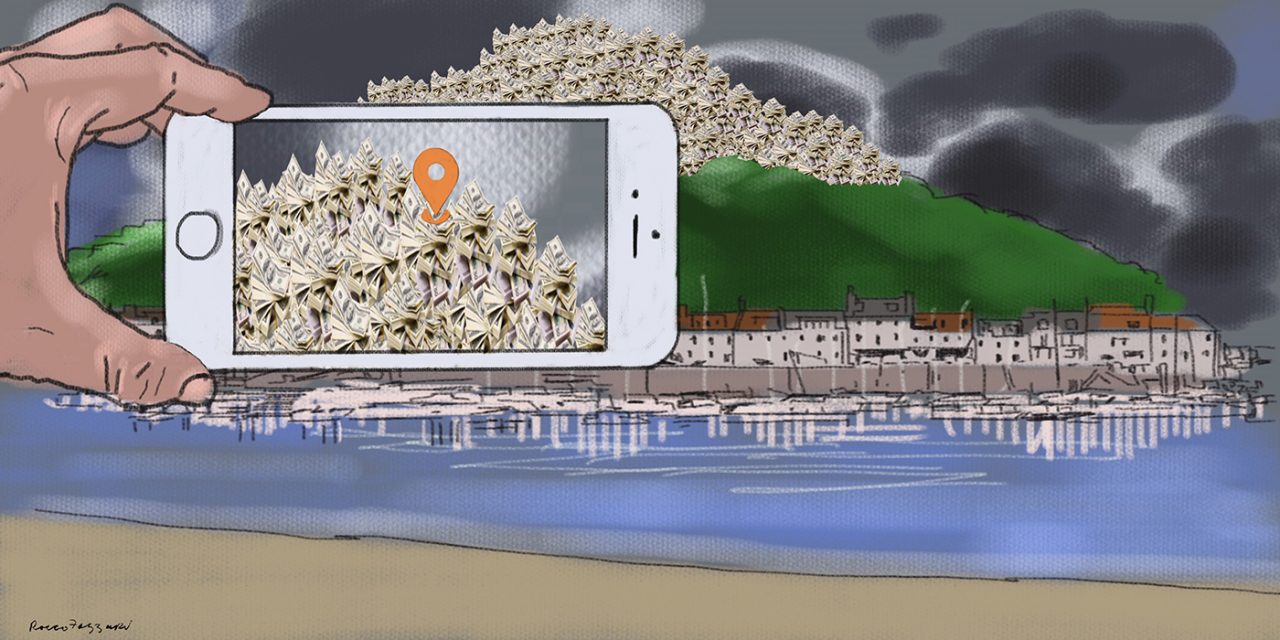

Some of the world’s wealthiest and most powerful people woke up Monday to discover that some of their best kept secrets – how they hide their vast wealth and avoid paying taxes – are now being read about in newspapers across the world after the release of a trove of offshore legal and banking documents were leaked to journalists and published Sunday as a joint project called the “Paradise Papers.”

First obtained by the German newspaper Süddeutsche Zeitung, the documents were then shared with scores of journalists and researchers associated with the International Consortium of Investigative Journalists and other media organizations, including the New York Times, BBC, and the Guardian.

“There is this small group of people who are not equally subject to the laws as the rest of us, and that’s on purpose,” said author and financial expert Brooke Harrington in response to the new insights about how these elites secretly manage their wealth.

As the ICIJ reports, the “trove of 13.4 million records exposes ties between Russia and U.S. President Donald Trump’s commerce secretary, the secret dealings of the chief fundraiser for Canadian Prime Minister Justin Trudeau, and the offshore interests of the Queen of England and more than 120 politicians around the world.”

#ParadisePapers – 13.4 million documents, 94 media partners, more than 120 politicians and world leaders. https://t.co/lHHyt9eLTS pic.twitter.com/mecTosLSxD

— ICIJ (@ICIJorg) November 5, 2017

According to the ICIJ, the documents show how deeply the offshore financial system is entangled with the overlapping worlds of political players, private wealth and corporate giants, including Apple, Nike, Uber and other global companies that avoid taxes through increasingly imaginative bookkeeping maneuvers.

One offshore web leads to Trump’s commerce secretary, private equity tycoon Wilbur Ross, who has a stake in a shipping company that has received more than $68 million in revenue since 2014 from a Russian energy company co-owned by the son-in-law of Russian President Vladimir Putin.

In all, the offshore ties of more than a dozen Trump advisers, Cabinet members and major donors appear in the leaked data.

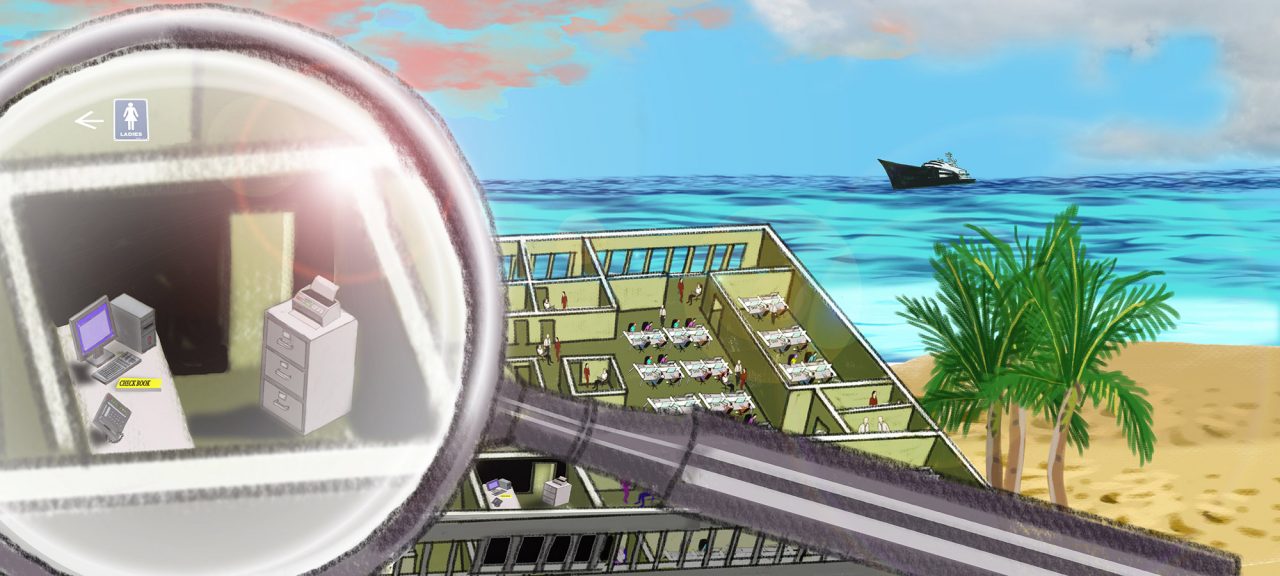

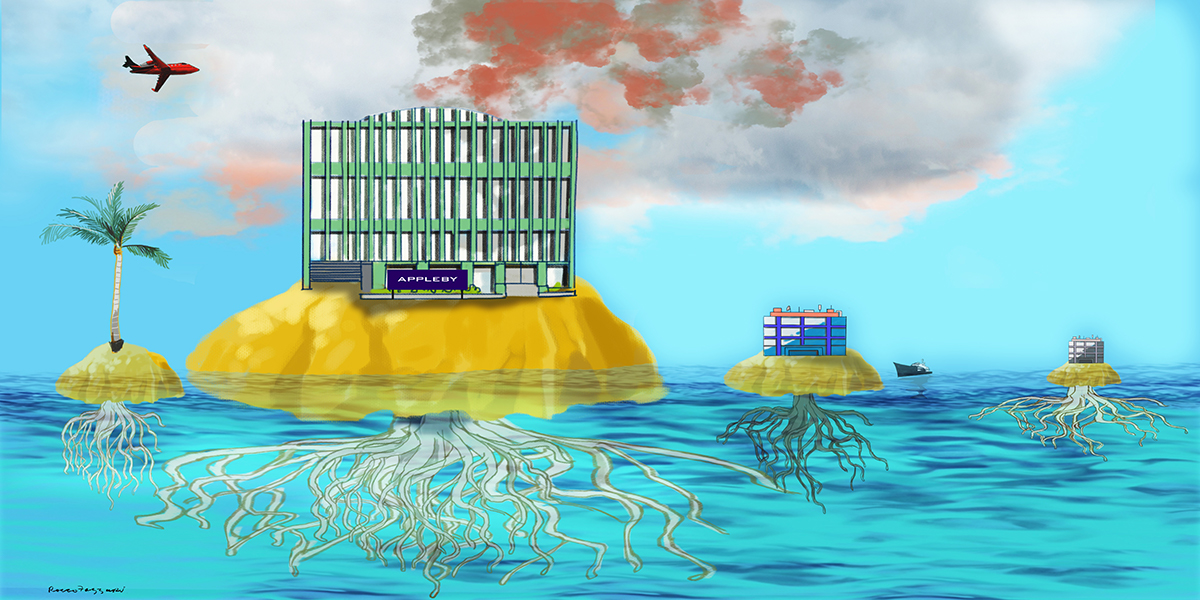

At the center for the leak, explains the Guardian, is the law firm Appleby, which has “outposts in Bermuda, the Cayman Islands, the British Virgin Islands, the Isle of Man, Jersey and Guernsey. In contrast to Mossack Fonseca, the discredited firm at the center of last year’s Panama Papers investigation, Appleby prides itself on being a leading member of the ‘magic circle’ of top-ranking offshore service providers.”

But what exactly do the Paradise Papers represent? This video explains:

According to a summary by the Guardian, the Paradise Papers reveal:

- Millions of pounds from the Queen’s private estate has been invested in a Cayman Islands fund – and some of her money went to a retailer accused of exploiting poor families and vulnerable people.

- Extensive offshore dealings by Donald Trump’s cabinet members, advisers and donors, including substantial payments from a firm co-owned by Vladimir Putin’s son-in-law to the shipping group of U.S. commerce secretary Wilbur Ross.

- How Twitter and Facebook received hundreds of millions of dollars in investments that can be traced back to Russian state financial institutions.

- The tax-avoiding Cayman Islands trust managed by the Canadian prime minister Justin Trudeau’s chief moneyman.

- A previously unknown $450 million offshore trust that has sheltered the wealth of Lord Ashcroft.

- Aggressive tax avoidance by multinational corporations, including Nike and Apple.

- How some of the biggest names in the film and TV industries protect their wealth with an array of offshore schemes.

- The billions in tax refunds by the Isle of Man and Malta to the owners of private jets and luxury yachts.

- The secret loan and alliance used by the London-listed multinational Glencore in its efforts to secure lucrative mining rights in the Democratic Republic of the Congo.

- The complex offshore webs used by two Russian billionaires to buy stakes in Arsenal and Everton football clubs.

Speaking with the Guardian, economist Gabriel Zucman – who is releasing a study later this week about the interplay between tax havens and global inequality – says the two are intricately linked.

“Tax havens are one of the key engines of the rise in global inequality,” he said. “As inequality rises, offshore tax evasion is becoming an elite sport.”

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License.

–

See also:

–

And:

Paradise Papers: Secrets of the global elites revealed

Dear Steve,

Today we look at two giant corporations we discovered in the Paradise Papers. Apple and Nike use clever tax maneuvers to reduce the amount of taxes they owe. As Edward Kleinbard, a former corporate lawyer, told our reporter Simon Bowers: “U.S. multinational firms are the global grandmasters of tax avoidance schemes.”

We also reveal how the clever offshore experts can reduce the amount of tax the rich have to pay on luxury jets and yachts.

And of course, there is some fallout from yesterday’s stories, including U.S. Commerce Secretary Wilbur Ross responding to our reporting that he has business ties with Russia.

Until tomorrow!

The ICIJ team.

P.S. I’d encourage you to also read this post by our grants manager, Caitlin Ginley Sigal, who explains how ICIJ funds projects like these. They sure aren’t cheap!

||

LATEST NEWS

Ross May Give Up Stake In Firm With Russia Ties

After yesterday’s revelations that U.S. Commerce Secretary Wilbur Ross had business ties with Russia, he refuted the claim that there was anything wrong with that. “There’s nothing whatsoever improper about Navigator having a relationship with Sibur,” he told the BBC. “If our government decided to sanction them, that would be a different story,” he continued. Ross said he had not misled Congress.

Apple’s Offshore Island Hop

Apple Inc. CEO Tim Cook told a U.S. Senate Subcommittee in 2013 that his tech company paid “all the taxes we owe.” However, the Paradise Papers reveal that months later Apple was shopping around for a tax refuge in a bid to keep its tax rates ultra-low. Apple turned to Appleby for help, and documents show the sensitive nature of working with the tech giant.

How Nike Stays Ahead Of The Regulators

The next multinational we found in the Paradise Papers was Nike. The shoemaker shifted billions in trademark profits between subsidiaries to avoid paying high taxes in Europe. The organization started using a Dutch CV, which most countries view as a regular company subject to taxes in the Netherlands. However, Dutch law considers the profits are subject to taxation outside of the Netherlands. Consequently, the organizations become almost stateless and minimize their tax.

Offshore Gurus Help Rich Avoid Tax On Jets And Yachts

Formula One champion Lewis Hamilton loves his $27 million candy-apple-red jet (just check out his Instagram feed). But he got a refund on the value-added tax (VAT) after lawyers at Appleby teamed up with Ernst & Young to sidestep the tax. “This will involve a short stay, normally less than 2 hours,” Appleby said in a written explanation of the tax-avoidance strategy.

Snax Haven – How To Hide The Secret Sauce And Save Millions

Welcome to Reg and Ruby’s burger shop, Snax Haven. A clever consultant helps them grow their profits by charging their franchise owners a secret sauce fee. The recipe is kept in a country where there is no tax paid. It’s not just Reg and Ruby who use these tactics.

Explore: The Politicians in the Paradise Papers

The Power Players interactive explores the offshore companies linked to 40 politicians and their immediate relatives.

Room Of Secrets Reveals Glencore Mysteries

‘Offshore Magic Circle’ Law Firm Has Record Of Compliance Failures

–

Previously in tax scammage:

* Deepwater Horizon Settlement Comes With $5.35 Billion Tax Windfall.

* Offshoring By 29 Companies Costs Illinois $1.2 Billion Annually.

* Government Agencies Allow Corporations To Write Off Billions In Federal Settlements.

* The Gang Of 62 Vs. The World.

* How The Maker Of TurboTax Fought Free, Simple Tax Filing.

* $1.4 Trillion: Oxfam Exposes The Great Offshore Tax Scam Of U.S. Companies.

* How Barclay’s Turned A $10 Billion Profit Into A Tax Loss.

* Wall Street Stock Loans Drain $1 Billion A Year From German Taxpayers.

* German Finance Minister Cries Foul Over Tax Avoidance Deals.

* Prosecutor Targets Commerzbank For Deals That Dodge German Taxes.

* A Schlupfloch Here, A Schlupfloch There. Now It’s Real Money.

* How Milwaukee Landlords Avoid Taxes.

* Study: 32 Illinois Fortune 500 Companies Holding At Least $147 Billion Offshore.

* Watch Out For The Coming Tax Break Trickery.

* When A ‘Tax Bonanza’ Is Actually A Huge Corporate Tax Break.

* The Hypocrisy Of Corporate Welfare: It’s Bigger Than Trump.

* Oxfam Names World’s Worst Tax Havens Fueling ‘Global Race To Bottom.’

* Offshore Tax Havens Cost Average Illinois Small Business $5,789 A Year.

* State Tax Incentives To Corporations Don’t Work.

Previously in the Panama Papers:

* The Panama Papers: Remarkable Global Media Collaboration Cracks Walls Of Offshore Tax Haven Secrecy.

* The Panama Papers: Prosecutors Open Probes.

* The [Monday] Papers.

* Adventures In Tax Avoidance.

* Mossack Fonseca’s Oligarchs, Dictators And Corrupt White-Collar Businessmen.

* Jonathan Pie, TV Reporter! They’re All In It Together.

* Meet The Panama Papers Editor Who Handled 376 Reporters In 80 Countries.

Previously in carried interest:

* Patriotic Millionaires Vs. Carried Interest.

* The Somewhat Surreal Politics Of A Private Equity Tax Loophole Costing Us Billions (That Obama Refused To Close Despite Pledging To Do So).

* Fact-Checking Trump & Clinton On The Billionaire’s Tax Break.

* Despite Trump Campaign Promise, Billionaires’ Tax Loophole Survives Again.

–

Comments welcome.

Posted on November 7, 2017