By Les Leopold/Common Dreams

Alarms are ringing from left, right and center over the $7 million grant by the state of Indiana to induce Carrier to keep 800 (not 1,100) jobs from moving to Mexico. (This downward revision comes from the Carrier Steelworkers local union president Chuck Jones, who courageously called Trump out for inflating the numbers. Trump has tweeted back twice to attack Jones, who now is receiving threatening calls from anonymous Trump supporters.)

Conservative pundits, so lost in their free market fictions, claim that Trump is interfering with the pristine operation of this system. He is picking winners and losers! He will ignite a trade war with his reckless tariffs! He will drive up prices of consumer goods! He will destroy more jobs than he will save!

“This is the sort of package Republicans have traditionally loathed,” reports the New York Times.

Hogwash.

The “bribe” for Carrier is barely a rounding error in the tens of billions of dollars in public money and tax breaks lavished upon corporations each and every day by Republicans and Democrats alike. Profits deeply depend on the well-honed corporate art of playing states and countries against each other in order to feast at the public trough. The conservatives’ beloved free enterprise system has never been free of corporate bribes and corporate job blackmail.

How Big Is The Corporate Welfare Trough? Very Big

The nonprofit research organization Good Jobs First has developed a corporate welfare tracker that goes back to 1976. There are 34 corporate welfare recipients who received over $1 billion (not million) in corporate welfare for a total of $84.5 billion in tax breaks and subsidies of the kind Carrier will receive. Here are the top 10:

- Boeing: $14,397,024,137

- Intel: $5,964,288,316

- GM: $5,832,287,385

- Alcoa: $5,798,922,493

- Ford: $4,044,067,895

- NRG Energy: $2,738,480,245

- Sempra Energy: $2,576,755,550

- Tesla Motors: $2,406,805,253

- NextEra Energy: $2,385,022,879

- Iberdrola: $2,248,534,669

For just one example among thousands, let’s look at Alcoa, No. 4 on the corporate bribe list. In 2015, the company was scheduled to eliminate 600 jobs at its aluminum facility in upstate New York (500 layoffs and another 100 positions that would not be filled.) Lo and behold, Democratic governor Andrew Cuomo and Democratic U.S. senator Charles Schumer came to the rescue with $38.8 million in capital and operation expenses from the state’s economic development arm, and another $30 million in energy cost assistance. Alcoa promised to keep the jobs in New York State for at least three years.

“I heard last night: Alcoa said they were going to keep the plant open,” Schumer, who turned 65 a day earlier said. “That was the best birthday present I could have received.”

[From Syracuse.com:

“Today’s $69 million deal to keep Alcoa open marks the fourth time in nearly a decade that New York has offered multi-million-dollar deals to the aluminum manufacturer.

“While those public subsidies have piled up, the promises from Alcoa have shrunk.

“And even with all those past agreements, Alcoa still had the power to shutter its Massena site and walk away without ever paying New York back, according to state officials.”]

The War Between The States

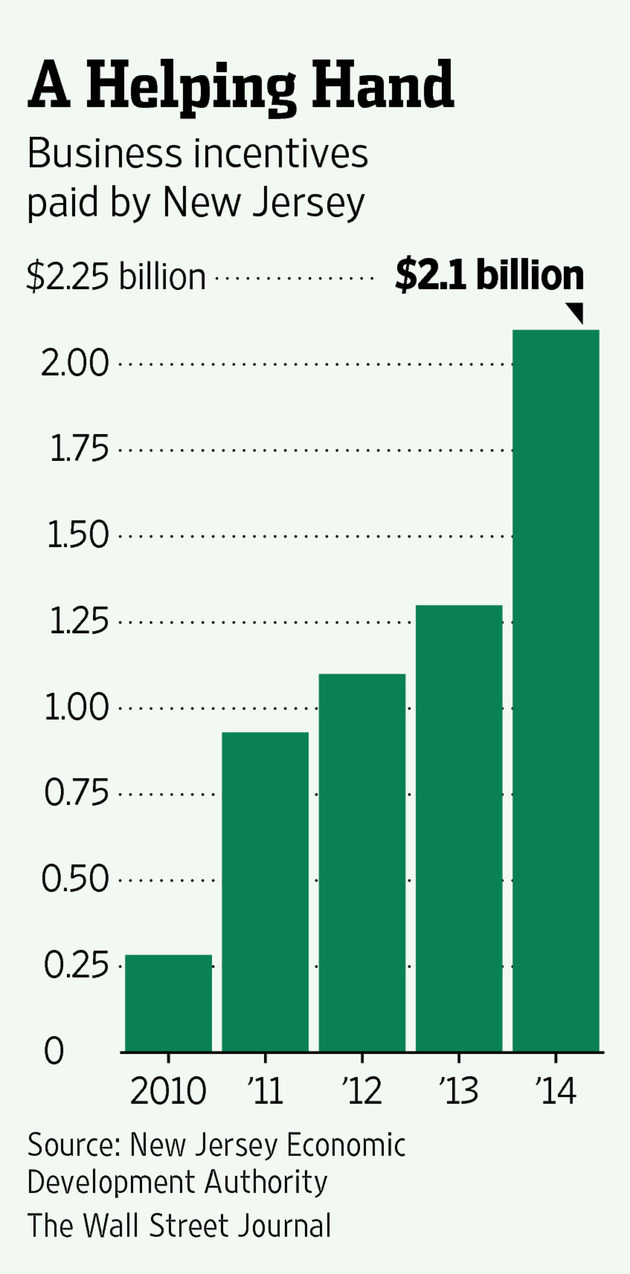

Not only do state and local governments worry about jobs evaporating or shifting abroad, but they are equally petrified about relocations to other U.S. states. New Jersey and Connecticut, for example, are in a cutthroat war to hold onto their own enterprises, while also luring other corporations to move jobs their way. New Jersey’s largesse, under a Republican governor, knows no bounds, reports the Wall Street Journal (“New Jersey Doubles Down on Incentives for Business – State Commits Billions in Subsidies to Lure Businesses, Keep Others From Moving.“) its corporate tax incentives, loans and cash bribes are rising rapidly.

Perhaps the most nauseating examples of corporate welfare are occurring in Connecticut (“The Constitution State”), the plush exurbia home to many Wall Street hedge funds.

Since hedge funds can operate wherever they place their people and computers, these jobs are mobile. One leafy suburb near New York and the Hamptons is as good as another. Therefore Connecticut is an easy target for some good old corporate blackmail coming from the richest of the rich. Here are two egregious examples, this time under a Democratic governor:

1. Bridgewater Associates LP, the world’s largest hedge fund: $22 million.

Supposedly this package, announced in May, was to induce Bridgewater, a $150 billion hedge fund, to keep 1,400 jobs in Connecticut, and then possibly to add 700 more by 2021

This deal is nothing short of obscene. Ray Dalio, the founder and CEO of Bridgewater, had a reported income of $1.4 billion in 2014. His net worth is $14.1 billion. So the subsidy from the state to his firm amounts to 0.16% of his net worth – about one tenth of a penny on every wealth dollar.

Worse still is that Dalio gets an enormous tax break called “carried interest.” Instead of being liable for a federal tax of 35 percent – before deductions – on his $1.4 billion ($490 million), his liability is only 20 percent ($280 million). So this hedge fund mogul takes advantage of a needless $210 million federal tax loophole and then still has the nerve to shake down the state for another $22 million. One wonders how Dalio justifies this level of greed.

2. AQR Capital Management: $35 million.

Once you bribe one billionaire hedge fund manager, get ready to do it again and again. On November 16, Connecticut announced a $35 million package of subsidies to another hedge fund that only has 540 jobs in the state but promises to add 600 more over the next ten years. Its CEO, University of Chicago alum Clifford Asness, has a reported net worth of $4 billion.

So let’s do the simple math on these corporate bribes:

- 600 Alcoa jobs = $114,667 per job.

- AQR’s 540 jobs = $64,815 per job.

- 1,400 Bridgewater jobs = $15,714 per job.

- Carrier’s $7 million for 800 jobs = $8,750 per job.

I hate to say this, but Trump got a deal.

–

Les Leopold is the director of the Labor Institute.

–

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License.

–

Previously in Tax Scammage:

* Deepwater Horizon Settlement Comes With $5.35 Billion Tax Windfall.

* Offshoring By 29 Companies Costs Illinois $1.2 Billion Annually.

* Government Agencies Allow Corporations To Write Off Billions In Federal Settlements.

* The Gang Of 62 Vs. The World.

* How The Maker Of TurboTax Fought Free, Simple Tax Filing.

* $1.4 Trillion: Oxfam Exposes The Great Offshore Tax Scam Of U.S. Companies.

* How Barclay’s Turned A $10 Billion Profit Into A Tax Loss.

* Wall Street Stock Loans Drain $1 Billion A Year From German Taxpayers.

* German Finance Minister Cries Foul Over Tax Avoidance Deals.

* Prosecutor Targets Commerzbank For Deals That Dodge German Taxes.

* A Schlupfloch Here, A Schlupfloch There. Now It’s Real Money.

* How Milwaukee Landlords Avoid Taxes.

* Study: 32 Illinois Fortune 500 Companies Holding At Least $147 Billion Offshore.

* Watch Out For The Coming Tax Break Trickery.

* When A ‘Tax Bonanza’ Is Actually A Huge Corporate Tax Break.

–

Previously in the Panama Papers:

* The Panama Papers: Remarkable Global Media Collaboration Cracks Walls Of Offshore Tax Haven Secrecy.

* The Panama Papers: Prosecutors Open Probes.

* The [Monday] Papers.

* Adventures In Tax Avoidance.

* Mossack Fonseca’s Oligarchs, Dictators And Corrupt White-Collar Businessmen.

* Jonathan Pie, TV Reporter! They’re All In It Together.

* Meet The Panama Papers Editor Who Handled 376 Reporters In 80 Countries.

–

Previously in the carried interest loophole:

* Patriotic Millionaires Vs. Carried Interest.

* The Somewhat Surreal Politics Of A Private Equity Tax Loophole Costing Us Billions (That Obama Refused To Close Despite Pledging To Do So).

* Fact-Checking Trump & Clinton On The Billionaire’s Tax Break.

* Offshore Tax Havens Cost Average Illinois Small Business $5,789 A Year.

–

Comments welcome.

Posted on December 10, 2016